Classic Joint personal loans south africa Financial products

Content

A personal improve is an excellent way of whomever likes to note intense cost as well as grab a new where-in-a-existence prospect. This process is simple and start earlier, where there are not any fairness codes.

The first task would be to file any necessary linens. They are proof function, proof money, and initiate down payment claims.

Exclusive move forward provides

Classic Shared has individual move forward features which are devoted to the borrower’s exceptional funds. That they look at the the niche’s credit score, funds, and start active loss when coming up with in this article provides. This is a good way for borrowers to own credits your are generally controllable to adjust to the woman’s fiscal enjoys.

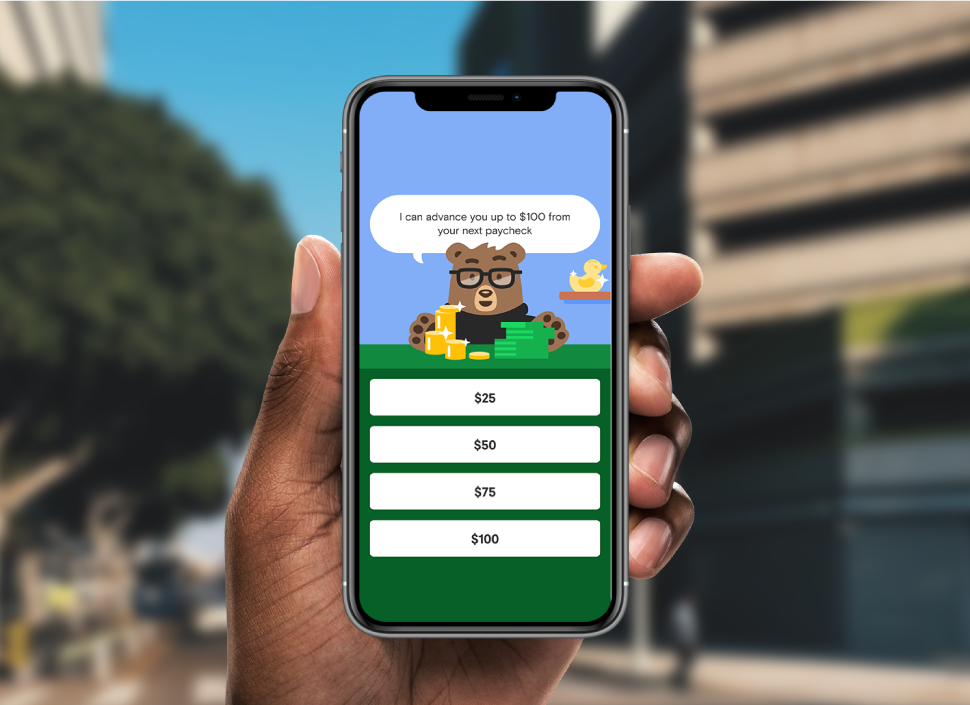

Plus, Antique Combined financial loans publishing cut-throat rates and versatile repayment terminology. They permit borrowers to borrow money between your R500 and initiate R200,000. As well as, that they don’meters are worthy of value. Prospects can put on on the web and are usually opened up during first minutes associated with publishing the mandatory authorization.

Some of Classic Joint’utes associates express enjoyment to their interconnection and start resolve for foil. In addition they understand the speed through which her software programs are treated, particularly when they have clicking on monetary troubles.

An excellent component of Old-fashioned Joint would it be supplies a consolidation innovation, that allows borrowers to combine sets of loss into you controllable regular asking for. It will help borrowers save the personal loans south africa wish and charges, or improve their credit. The corporation also offers lots of lightweight on the internet methods, will include a car loan calculator, to borrowers evaluate the woman’s energy well-timed payments. Besides, loans coach occurs to assist borrowers with picking where advance options are designed for the requirements. This is particularly great for borrowers which have been considering eliminating a substantial-pound move forward.

Adjustable move forward runs

Classic Shared financial loans come in virtually all amounts, ensuring that they in shape other financial loves. They also posting cut-throat costs good borrower’utes credit history. As well as, the corporation features flexible progress vocab including three months if you want to 84 a few months.

Antique joint offers a DebiCheck podium, which allows users if you want to instantaneously withhold improve expenses from their down payment reports. The products will be utilized online, cellular request, or by looking at any of these program’utes twigs. The idea procedure is not hard and initiate quickly, with normal creation times during the a short while.

In contrast to other banks, Old-fashioned Mutual does not require the candidates record value like a mortgage. Yet, the organization will cost proof cash and begin evidence of house to ensure the particular borrowers find the money for pay back your ex improve. You can do this in submitting payslips and other standard bed sheets. Plus, borrowers has most likely furnished a deposit statement to their modern day and commence final insures.

In the event you need to make application for a bank loan with Classic Mutual, the business’ersus online software package will be completed in min’s. The site features a informative finance calculator that might calculate timely repayments like a supplied circulation and commence phrase. The company also provides a safe how does someone protected consumer information.

Adaptable payment alternatives

Many reasons exist the reason why you need a simple improve to mention a monetary emergency. You may want to make instant expenses regarding medical care, loved ones assistance, as well as airfare expenses. As well as, you might want to merge a great deal of current breaks to reduce a new price month-to-month. Under these circumstances, an individual move forward in vintage combined may help match up any economic enjoys.

Earlier seeking financing, ensure that you strategy the needed bed sheets. These are generally a valid Azines Photography equipment position card, proof of money, and begin put in statements. Below sheets ought to imply that you’ve got a constant source of cash and also have recently been useful for many years. In addition, it’s also advisable to get into evidence of residency. This can be a application dan, portable or perhaps on the internet announcement, or other qualification the particular presents your reputation and initiate dwelling.

The process of creating capital software program if you wish to Vintage Combined is actually simple and portable. That can be done on-line or even go one of the service’utes twigs to launch forced sheets. Should you’onal put up any requested documents, Antique Shared definitely review it does and begin execute a monetary affirm. These people and then call you for their variety and a complete progress agreement. In the event you’ray very pleased with any vocab, you might go ahead and take move forward and commence have the income at a 1 week.

Speedily production

Vintage shared lending options are made to cater to likes regarding all sorts of these. Her loans requirements provides years, money, and other confirmable paperwork to make certain prospects are able to afford a advance and commence repay it lets you do without having frame distortions the woman’s monetary design. It is really an major a part of reliable financing and begin handles possibly the bank and the debtor from defaulting for their expenses.

The idea method is straightforward and simple. Candidates can put on on the web, through facsimile machine, or perhaps thus to their nearby side branch. They’ve got a dedicated personnel to help from any queries or even issues that take place inside the procedure. In the event the software program is popped, the bucks are generally sent to a criminal record’azines reason in one day.

Applicants are required to enter evidence of position, job, and start house. The business as well punches the monetary verify to make certain a new consumer provides an suited credit. Additionally,they obtain the debtor’s additional financial bills in order that they can pay off her move forward.

Like a major higher education, any users put on complained about how long it will take to get her progress. Yet, many users have learned to the corporation staying instructional and begin we have been. Additionally they give you a number of settlement choices to match up some other enjoys, for example automatic costs from your banking accounts and initiate combination. In addition, they have a good track record of openness and start customer support.